Chevrolet Leads Truck Sales, Toyota Comes in Second During the First 5 Months of 2024

10.5% Growth in Truck Sales in May 2024

Chevrolet Leads Truck Sales, Toyota Comes in Second During the First 5 Months of 2024

The monthly report issued by the Automotive Market Information Council (AMIC) revealed significant growth in the truck sector, marking the first increase since the beginning of the import crisis in the first quarter of 2022. Truck sales surged by approximately 10.5% in May 2024 alone, with over a thousand trucks sold compared to about 924 trucks in May 2023.

Decline in Locally Assembled Truck Sales

Sales of locally assembled trucks declined during the first five months of 2024, totaling 3.8 thousand trucks compared to over 4 thousand trucks during the same period in 2023, representing a 5.4% decrease according to the AMIC report.

Decline in Imported Truck Sales

Imported truck sales also saw a notable decline, with 830 trucks sold during the first five months of 2024 compared to 1.2 thousand trucks in the same period in 2023, a decrease of 31%.

Top-Selling Truck Brands in 2024

- Chevrolet: Chevrolet topped the truck market sales in the first five months of 2024, capturing the largest market share with a total of 3.3 thousand trucks, or 71.5% of the market.

#image_title - Toyota: Toyota came in second with a market share of approximately 13%, selling 612 trucks.

#image_title - Mitsubishi: Mitsubishi rose to third place with a market share of about 7%, selling 330 trucks.

#image_title - MCV/Mercedes: This brand climbed to fourth place with a market share of 3.3%, selling 157 trucks.

#image_title - GMC: GMC fell to fifth place with a market share of about 2.6%, selling 124 trucks.

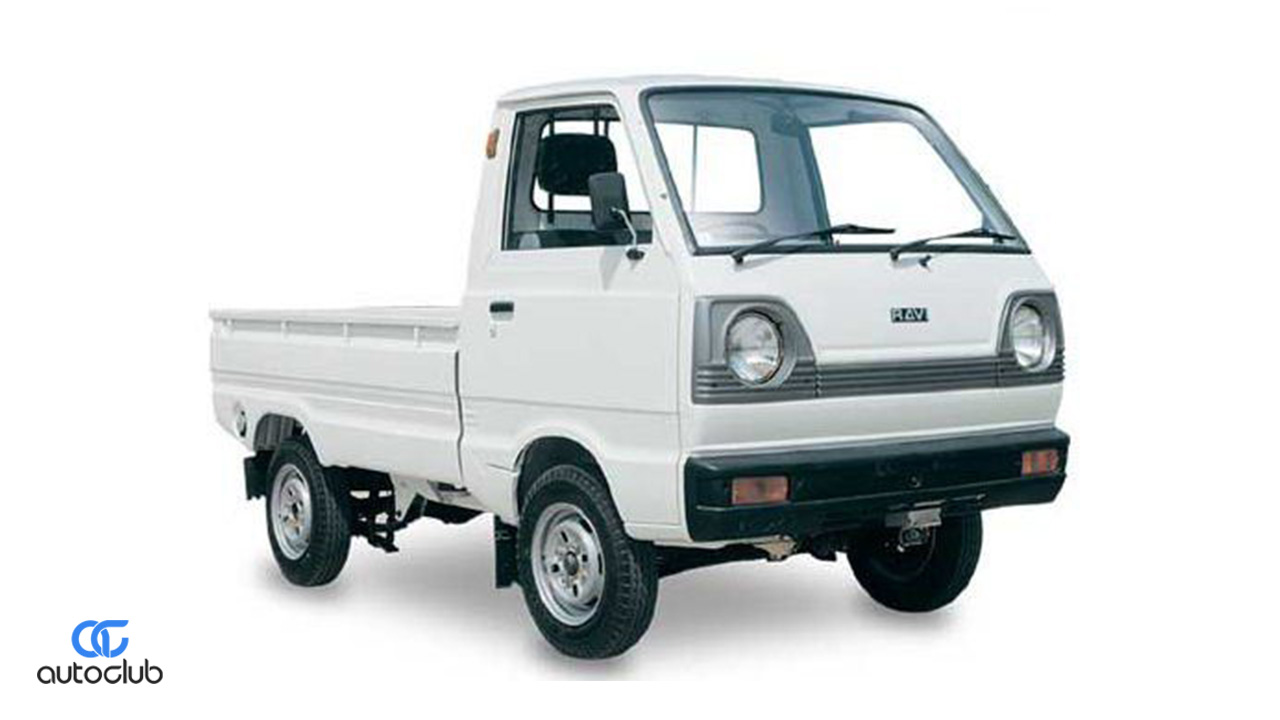

#image_title - Suzuki: Suzuki secured sixth place with a market share of 1.1%, selling 50 trucks.

#image_title - Hyundai: Hyundai came in seventh place with 43 trucks sold.

#image_title - Volvo: Volvo ranked eighth with 16 trucks sold.

#image_title - Shacman: Shacman placed ninth with 9 trucks sold.

#image_title

Overall Decline in Truck Sales

Sales of trucks across various categories declined by 11% during the first five months of 2024, with a total of 4.6 thousand trucks sold compared to 5.2 thousand trucks in the same period in 2023.

Conclusion

The AMIC report highlights a mixed performance in the truck market during the first five months of 2024. Despite the overall decline in both locally assembled and imported truck sales, Chevrolet emerged as the market leader, significantly outpacing its competitors. The report suggests a cautious yet optimistic outlook for the remainder of the year, contingent on economic conditions and supply chain improvements.